China issues its first central document on carbon market development

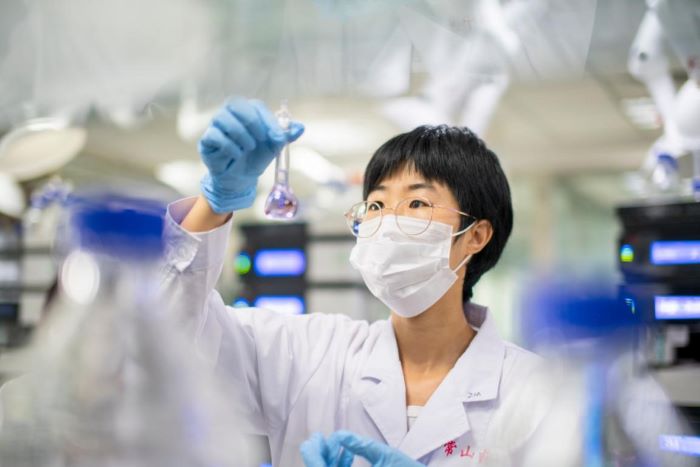

Agency : The carbon market is a crucial policy instrument for leveraging market mechanisms to address climate change and accelerate the transition toward a green, low-carbon economy.

In a significant step toward strengthening the nation's commitment to climate action, China has unveiled a guideline to accelerate the country's green and low-carbon transition and strengthen the construction of the national carbon trading market.

This document represents the first central government document dedicated to the carbon market, providing robust institutional frameworks and enhanced capacity-building support. The goal is to cultivate a more effective, dynamic, and internationally influential carbon market.

China has already established a national carbon emissions trading market for major emission sources to fulfill mandatory reduction obligations. Furthermore, a voluntary greenhouse gas reduction trading market has been developed to encourage self-reduction efforts by the broader society.

"These two markets operate independently but are connected through an offsetting mechanism that allows the surrender of allowances. Together, they form a unified national carbon market system that ensures full coverage of emitters," explained Xia Yingxian, an official with China's Ministry of Ecology and Environment.

In March this year, the mandatory carbon market expanded for the first time to include the steel, cement, and aluminum smelting industries - sectors responsible for over 60 percent of China's total carbon dioxide emissions.

Since 2023, China's Ministry of Ecology and Environment, in collaboration with relevant departments, has issued six methodologies, including those for afforestation carbon sinks and offshore wind power, progressively expanding the voluntary carbon market.

As of August 22 this year, the cumulative trading volume in the mandatory market had exceeded 680 million tons, with a transaction value of 47.41 billion yuan ($6.66 billion). The voluntary market recorded cumulative trading of 2.49 million tons of certified voluntary emission reductions, totaling 210 million yuan.

To reinforce institutional development, China's Ministry of Ecology and Environment and relevant departments have introduced more than 30 regulations and technical standards, establishing a multi-tiered and relatively comprehensive regulatory framework for the carbon market. Authorities have intensified supervision of data quality, employing digital tools to issue early warnings on potential data risks and cracking down on the falsification of carbon emissions data.

"After years of development, China has established a preliminary carbon market system with distinctive Chinese characteristics. A carbon pricing mechanism centered around the carbon market is steadily taking shape," said Yan Gang, head of the South China Institute of Environmental Sciences under the Ministry of Ecology and Environment.

The acceleration of carbon market development will allow the market to play a decisive role in resource allocation, stimulate widespread participation in green and low-carbon practices, and spur innovation in low-carbon, zero-carbon, and negative-carbon technologies. This is crucial for fulfilling emission reduction responsibilities, achieving dual carbon targets, and reducing overall abatement costs for society.

The newly released guideline outlines a clear "timetable" and "roadmap" for the future development of the national carbon market.

From the perspective of the mandatory carbon market, by 2027, the coverage will gradually extend beyond the existing power generation, steel, cement, and aluminum industries to include other major industrial emitters.

In the voluntary carbon market, which currently includes renewable energy, methane reduction, energy efficiency, and forestry carbon sinks, new areas such as biomass utilization, solid waste treatment will be incorporated, with comprehensive sector coverage by 2027. By 2030, China aims to establish a voluntary carbon market that is trustworthy, transparent, standardized, widely accessible, and aligned with international standards.

The management of emissions allowances is essential for ensuring the efficient and orderly operation of the Chinese national carbon market and achieving policy objectives. The guideline stresses the need for a predictable and transparent system for carbon quota allocation.

According to Xia, China currently adopts an intensity-based approach to allowance allocation. Moving forward, in line with the "dual carbon" goals, the nation will gradually shift to a cap-based system. By 2027, industries with relatively stable emissions will face absolute caps, with a pre-established national emissions cap allocated to enterprises through a top-down approach.

At the same time, China will explore both free and paid allocation methods, establish an allowance reserve, and introduce a market adjustment mechanism to balance supply and demand, thereby enhancing market stability, liquidity, and risk management capabilities.

By advancing the development of its carbon market, China will combine an effective market with proactive government policies to ensure a vibrant yet well-regulated system, thereby unleashing green productivity, creating new quality productive forces, and driving the comprehensive green transformation of economic and social development.

=By Kou Jiangze, People's Daily

प्रतिकृया दिनुहोस